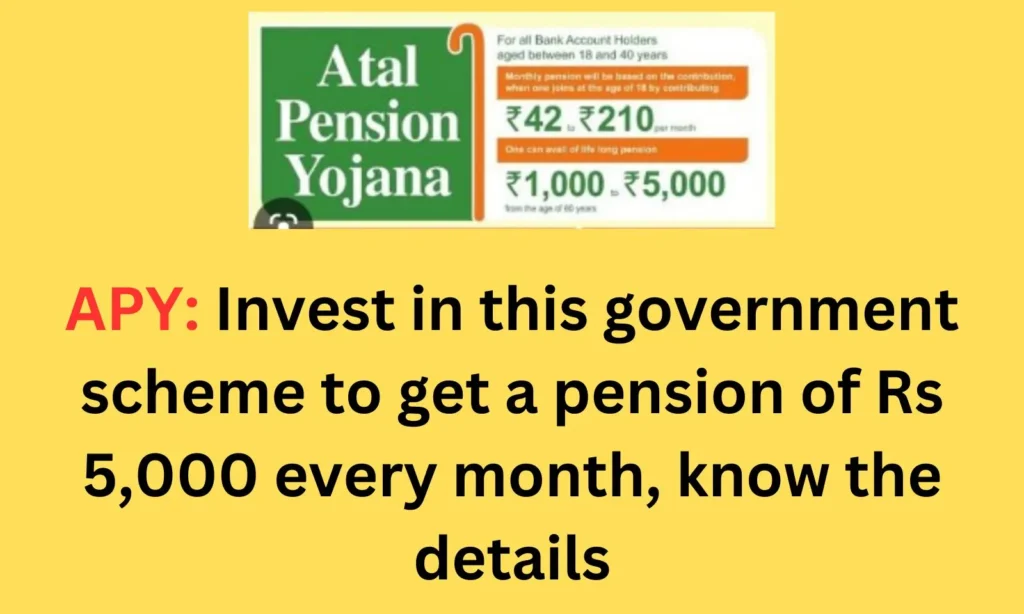

Atal Pension Yojana: If you also want that, after the age of 60 years, you get a pension of ₹ 1,000 to ₹ 5,000 every month, then to fulfill your wish, we will give you the Atal Pension Yojana in detail in this article. Will tell about Pension Yojana, to get complete information about which you will have to read this article till the end.

Along with this, we will provide you an approximate list of the documents that all the youth and applicants will need to apply for the Atal Pension Yojana, so that you can easily apply for this welfare pension scheme and get the benefits of this scheme. .

On the other hand, we will provide you quick links so that you can easily get similar articles and get their benefits.

Table of Contents

Atal Pension Yojana – A Glance

- Scheme Name ;-Atal Pension Yojana

- Article Name ;-Atal Pension Yojana

- Article Type;- Government Scheme

- Analysis of eligibility, documents and application process required for application in the topic scheme of the article

- The aim of the plan is to ensure continuous social and economic development of the youth and common citizens of the country.

- Basic Benefits of the Scheme Atal Pension Yojana (APY) After the age of 60 years, Rs.1000, Rs.2000, Rs.3000, Rs.4000, Rs.5000 per month pension is provided to the applicants

- Mode of Application;- Offline

- Official Website ;-Click Here

Get a pension of ₹ 1,000 to ₹ 5,000 after 60 years, know what is the complete plan – Atal Pension Yojana?

In this article, we want to warmly welcome all of you readers and citizens who want to do something from now on for their happy and joyful life after 60 and that is why, in this article, we will give you detailed information about Atal Pension Yojana. Will tell about for which you have to read this article carefully.

Let us tell you that, to apply in Atal Pension Yojana, all of you applicants will have to adopt the offline application process, in which you do not have any problem or difficulty, for this we will provide you the information about the complete application process so that all of you can easily apply in this scheme. Can apply and get its benefits.

On the other hand, we will provide you quick links so that you can easily get similar articles and get their benefits.

Atal Pension Yojana – What are the main benefits?

Come, now we want to tell you about the benefits you will get under this scheme with the help of some points, which are as follows –

- A wonderful pension scheme has been launched by the Government of India for all the youth and citizens of the country.

- All the citizens and youth of the country can get the benefits of this scheme by applying for Atal Pension Yojana to secure and protect their future.

- Atal Pension Yojana (APY) Rs.1000, Rs.2000, Rs.3000, Rs.4000, Rs.5000 per month pension is provided to the applicants after the age of 60 years,

- For everyone to get the benefit of this scheme, all of you applicants can get the benefit of this scheme by applying online or offline from any bank or post office,

- If you do only 210 under this scheme, then after 60 years you will be given a pension of 60,000 rupees annually, which will not only lead to your social and economic development, but will also create your bright future etc.

- Lastly, in this way, we told you about the benefits that you will get under this scheme so that you can apply in this scheme as soon as possible and get its benefits.

Atal Pension Yojana – What is the essential qualification?

All of you applicants will have to fulfill certain qualifications to apply in this scheme, which are as follows –

- All applicants must be Indian citizens and residents,

- The age of the applicant should be between 18 years to 40 years etc.

- By fulfilling all the above qualifications, you can apply in this scheme and get its benefits.

What documents will be demanded for the application in Atal Pension Yojana?

To apply in this welfare scheme, all of you applicants will have to supply some documents which are as follows –

- Aadhaar Card of Applicant,

- pan card of applicant,

- Bank Account Passbook,

- Passport Size Photograph and

- Active Mobile Number Etc.

- By filling all the above documents, you can easily apply in this scheme and get its benefits.

Atal Pension Yojana – How to apply?

In Atal Pension Yojana, to apply online, all our applicants and youth have to follow these steps, which are as follows –

To apply in Atal Pension Yojana, first of all click on this Application Form (Direct Link) and download and print the application form which will be as follows –

- Now you have to fill this application form very carefully.

- Self-attested photocopies of all required documents must be attached with the application form.

- Lastly, you have to submit this application form to your bank and get its receipt etc.

- Lastly, in this way all of you can get the benefits of this scheme by applying easily.

Conclusion

In this article, we have not only told all the youth and citizens in detail about Atal Pension Yojana, but we have also told you about all the attractive benefits and features that you will get under this scheme so that you can join this scheme as soon as possible. You can get the benefit of this scheme by applying.

Lastly, all of you applicants must have liked this article very much, for which you will like, share and comment on this article.

Quick Links

| Quick LInks | APY Subscriber Registration Form APY Subscriber Registration Form – Swavalamban Yojana Subscribers APY Subscriber Information Brochure in Hindi/English |

| Official Website | Click Here |

FAQ’s – Atal Pension Yojana

What is the rule of Atal Pension Yojana?

You will get a fixed pension of Rs 1000, 2000, 3000, 4000, or 5000 rupees every month after attaining the age of 60 years depending upon the contribution made by you in the scheme. While enrolling in the scheme, you have to choose the amount of your pension, but keep in mind that the installments will also be made according to your chosen amount.

How much amount is given in Atal Pension Yojana?

Atal Pension Yojana calculation is per month. 1454 Rs. Maximum contribution of Rs.5000 at the age of 40 years. for the pension amount of Rs.

This post was last modified on February 21, 2023 5:16 pm